Have you ever needed a new trailer but couldn’t afford to purchase one or didn’t have the credit to qualify for traditional financing? Then rent to own trailers might just be the perfect solution for you.

- A rent-to-own program provides flexible financing solutions with no credit checks and tailored payment plans for your trailers.

- Dump, utility & equipment trailers are available for rent to own, ranging in price from $2,500 – $30K.

- Consider geographic restrictions & maintenance/warranty coverage when comparing rent to own vs traditional financing benefits.

In this post, we will explore the world of rent-to-own trailers, their benefits, the types of trailers available, and how you can get started with a rent-to-own trailer program. We’ll cover how enclosed trailer rental works, where to find rent to own car hauler trailers, and covered moving trailers for rent.

If you want to get started with an enclosed cargo trailer, an easy way to do so is to search “rent to own trailers near me” and check out what’s available in your area.

Understanding Rent-to-Own Trailer Programs

A rent-to-own trailer program is designed to help those who need a new trailer but cannot afford to purchase one outright or do not have the credit to qualify for traditional financing. These programs offer a flexible and convenient alternative, allowing customers to make monthly payments towards ownership of their desired new trailer, such as a car hauler or equipment trailer, without the need for a credit check. They also come with the option to purchase the trailer at any time.

For example, Trailer RTO offers a rent-to-own program that enables customers to rent any rent-to-own trailers on a flexible monthly installment basis without requiring a credit check. This provides individuals and businesses with the opportunity to acquire a new trailer without the upfront cost, making it a perfect solution for those with limited financial resources or bad credit.

No Credit Check Financing

One of the most attractive features of a rent-to-own program is the no credit check financing. This means that customers can be automatically approved and obtain financing for their trailer without having to worry about their credit score or history.

To participate in a rent-to-own program, you only need a valid driver’s license, social security number, phone number verification, and proof of residency as indicated on the driver’s license. There are no credit checks involved, making it an accessible program option for those with bad credit or no credit history.

Monthly Payments and Ownership

A rent-to-own utility trailer, for instance, allows individuals and small businesses to obtain the hauling capacity they need without the upfront cost. Instead, customers can make monthly payments over a predetermined rental term, allowing them to spread out the cost over time with the option to purchase at any time.

Flexible payment plans of 24, 36, and 48 months are typically offered, ensuring that customers can find a plan that suits their budget. Additionally, customers have the option to switch trailers without any obligation to continue payments, allowing them to enter a new rent-to-own agreement if their needs change. They may also purchase their trailer outright at any time.

Types of Trailers Available for Rent-to-Own

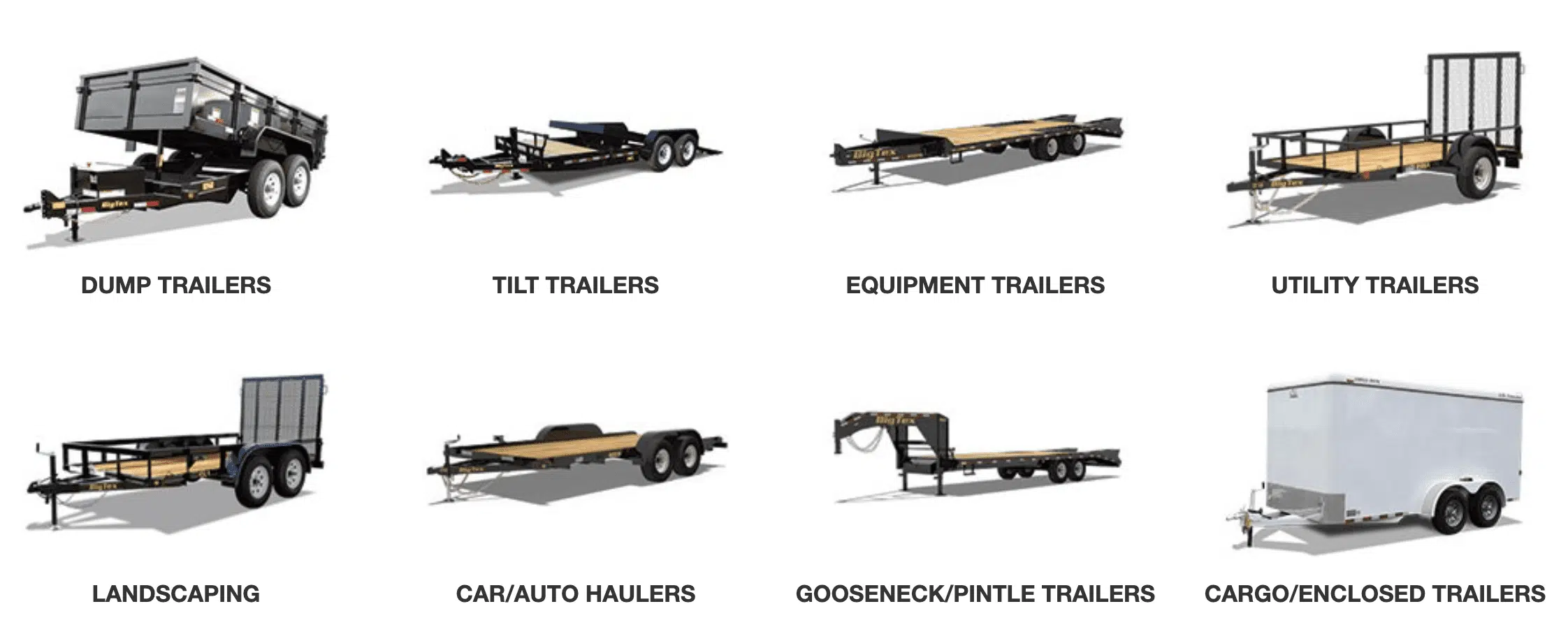

A rent-to-own program offers a wide range of rent-to-own trailers to suit various needs and purposes. Customers can choose from dump trailers, car trailers, utility trailers, equipment trailers, gooseneck trailers, and enclosed cargo trailers, ensuring they can find the perfect trailer for their specific requirements.

Companies like Trailer Empire boast an extensive selection of the highest quality trailers available, with purchase prices ranging from $2,500 to $30,000, and a maximum financing amount of $30,000, making it easy for customers to find trailers that fit their budget.

Dump Trailer

Dump trailers are a popular choice for the construction and landscaping industries. A dump trailer features an open box bed and the capability to raise the front of the dump trailer bed for convenient dumping of materials.

A rent-to-own dump trailer offers customers the convenience of immediate use with the flexibility of deferred payment, making them an attractive option for businesses and individuals alike.

Lease to own dump trailers are widely used for transporting and depositing large volumes of materials such as gravel, dirt, or mulch, making dump trailers essential pieces of equipment for many landscaping or construction businesses.

For more on dump trailers, check out our Best Dump Trailer Buying Guide or get the answer to How Much are Dump Trailers.

Utility Trailer

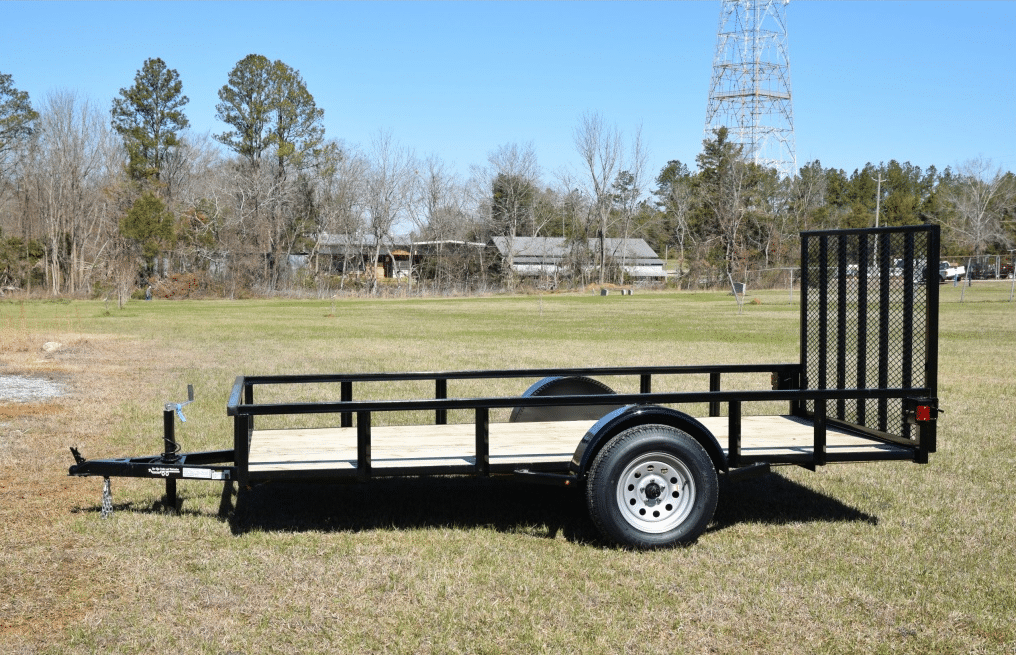

Utility trailers are a popular choice for personal use. They are great for hauling small cargo and equipment and can typically be towed by a small automobile. Lots of people use them for hauling all sorts of lawn mowers including zero turn mowers, riding lawn mowers, and push mowers.

Utility trailers have an open-top rear cargo area (bed) and are easier to access than heavy equipment trailers. They are primarily used for hauling cargo and can also be utilized as a home, office, store, or display.

Renting to own a utility trailer offers financial flexibility, credit leniency, and customized payment plans, making them an appealing option for many customers. To acquire a utility trailer, customers should select the most suitable option for their requirements and then complete the rent-to-own application, submitting any necessary documents.

Equipment and Enclosed Cargo Trailers

Another popular option in rent-to-own trailers is equipment and enclosed trailers or cargo trailers.

An equipment trailer is a specialized trailer designed for the transportation of heavy machinery. An equipment trailer might be used to transport a skid steer, excavator, or other type of tractor.

Depending on the size of your equipment, these trailers may also be necessary for hauling a lawn mower, particularly zero turn lawn mowers.

An enclosed trailer offers a secure and weather-resistant space for transporting goods. An enclosed trailer, or cargo trailer, might be used to haul cargo that cannot get wet such as furniture, or sensitive gear.

An enclosed trailer also makes a great motorcycle trailer or even a car hauler. They are also great trailers for personal use. Rent to own enclosed trailers, or even buy here pay here enclosed trailers, are popular in Florida due to extreme weather conditions and are good options when searching for a motorcycle trailer for rent.

A rent-to-own equipment trailer or cargo trailer finance provides the same financial flexibility, credit leniency, and customized pay plans as other rent-to-own trailer types. Therefore, a cargo trailer or equipment trailer is an attractive option for businesses and individuals in need of a new trailer.

Gooseneck Trailers

Gooseneck trailers are specifically designed for heavy-duty towing and hauling applications.

They are commonly used for:

- Hauling livestock: Gooseneck trailers are often used in the agricultural industry for transporting livestock such as horses, cattle, or pigs.

- Transporting heavy tools: Gooseneck trailers are capable of carrying heavy machinery and equipment such as construction vehicles, tractors, excavators, and other large loads.

- Car hauling: Gooseneck trailers are frequently used for transporting multiple cars or vehicles, including race cars, classic cars, and other automotive vehicles.

- Industrial and commercial hauling: Gooseneck trailers are suitable for various commercial hauling purposes, such as transporting building materials, supplies, or large cargo.

- Agricultural equipment transportation: Farmers and agricultural businesses often use gooseneck trailers to transport heavy farming equipment, including tractors, harvesters, and implements.

Advantages of Rent-to-Own Trailer Programs

A rent-to-own program comes with numerous benefits, making them an attractive alternative to traditional trailer financing options. Financial flexibility, credit leniency, the ability to purchase trailers outright, and tailored payment plans are just a few of the advantages that customers can enjoy when opting for rent-to-own trailers.

Customers who may not qualify for traditional financing due to their credit history or lack of funds for a down payment can still acquire the trailer they need through a rent-to-own program. This allows them to make monthly payments towards eventual ownership of the trailer without needing a credit check or a large upfront payment. They may also choose to purchase the trailer outright at any time.

Financial Flexibility

Financial flexibility is an essential aspect of rent-to-own trailers, as it allows customers to respond effectively to their cash flow or investment prospects. Companies that offer rent-to-own trailers strive to provide flexible terms and conditions, making it easier for customers to manage their finances and adapt to any unforeseen expenses or investment opportunities.

By offering customizable payment schedules and the option to modify expenses in response to market changes, rent-to-own trailer programs enable customers to optimize their value and guarantee their ability to fulfill their liabilities, making it an attractive option for those with limited financial resources or poor credit.

Credit Leniency

Credit leniency is another advantage of rent-to-own trailers, as it offers a more flexible approach to credit requirements. This enables customers with unfavorable credit or limited credit history to access financing for their trailer without the need for a credit check, having to pay the total price, or making a large down payment.

While credit leniency may come with some restrictions, it provides an accessible option for those who may not be eligible for traditional financing due to no or poor credit history.

Tailored Payment Plans

Tailored pay plans are another benefit of a rent-to-own program. These customizable schedules are crafted to suit the individual requirements of clients, allowing them to make payments according to their own preferences and financial circumstances instead of paying the total price at the time of pick-up.

By offering tailored pay plans, rent-to-own trailer programs enable customers to acquire a trailer without undergoing a conventional financing process, providing them with increased financial flexibility and the option to adapt their fee schedule to suit their needs.

How to Get Started with Rent to Own Trailers

Getting started with rent-to-own trailers is a straightforward process. First, customers should choose the right trailer for their needs, taking into consideration factors such as size, weight, and features. Once they have selected the appropriate trailer, they can then complete the rent-to-own application, providing personal information such as their name, address, and contact information, as well as proof of income and other financial information.

After submitting the application and making an initial payment, which consists of the first month’s rent and a small deposit, customers can collect their trailer by providing a driver’s license and signature. The individual collecting the trailer must have the same name that appears on the rent-to-own application.

Choosing the Right Trailer

There are many types of trailers. Selecting the right trailer for your needs is crucial for ensuring that you get the most out of your rent-to-own program. Consider factors such as the purpose of the trailer, the weight of the load, and the towing capacity of your vehicle when making your decision.

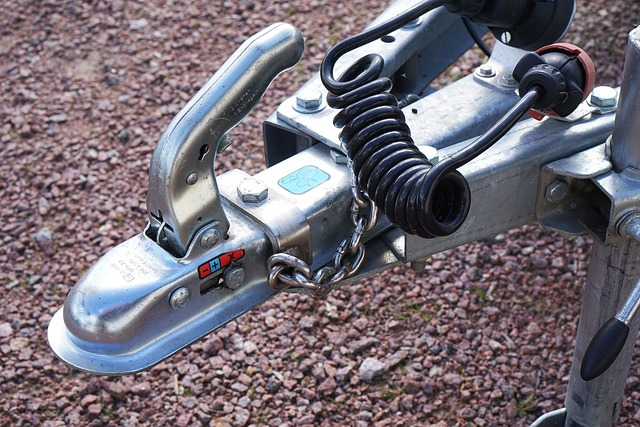

Additionally, it is essential to take into account other factors such as the type of hitch, construction, and suspension of the trailer, warranty, brand reputation, stability and financial strength of the manufacturer, as well as maintenance requirements, to ensure that you choose the best trailer for your hauling needs.

Completing the Rent-to-Own Application

To complete the rent-to-own application, customers must provide personal information such as their name, address, contact information, proof of income, and other financial information. A copy of your driver’s license is required. Additionally, two proofs of residence and contact information for personal references who can verify your identity are also necessary.

If you are renting your home, contact information for your landlord is also required. Once the application is submitted and the initial payment is made, customers can collect their trailer by providing a driver’s license and signature with the same name that appears on the rent-to-own application.

Rent-to-Own Program Limitations and Considerations

While a rent-to-own trailer program offers numerous benefits, there are some limitations and considerations to bear in mind. Rent-to-own programs may involve higher overall costs compared to a trailer loan, stricter terms than traditional financing options, higher monthly payments, nonrefundable upfront fees, and geographic restrictions.

Geographic restrictions refer to limitations on the availability of rent-to-own programs based on location. These restrictions may depend on the company offering the program and the stipulations of the rental agreement.

For example, some rent-to-own programs may not be available in all states. However, residents in those states may still be able to apply for personal or business loans as an alternative to rent-to-own trailer programs. An advantage to this can be that your trailer loan payment is lower than a rent to own payment.

Trailer Maintenance and Warranty

Regular trailer maintenance is essential for maintaining the longevity of your trailer and ensuring its safe operation. This includes checking air pressure, inspecting suspensions, lubricating correctly, attending to brakes, ensuring illumination, and keeping it clean.

When considering a rent-to-own program, it’s essential to take into account the maintenance requirements and warranty coverage. Rent-to-own trailers generally include a limited warranty that covers any flaws in materials or craftsmanship, but the warranty period and coverage will depend on the trailer manufacturer.

Comparing Rent-to-Own with Traditional Financing

When deciding between a rent-to-own program and traditional financing, it’s essential to weigh the pros and cons of each option. Rent-to-own programs offer financial flexibility, credit leniency, and tailored payment plans, but may come with higher overall costs and stricter terms than traditional financing options.

The optimal option for customers depends on their individual requirements and financial circumstances. Rent-to-own may prove to be advantageous for those who require more time to accumulate funds for a down payment or who have poor credit. Conversely, traditional financing may be more suitable for those who can provide a down payment and have good credit.

Summary

A rent-to-own trailer program offers a flexible and convenient alternative to traditional financing for individuals and businesses in need of rent-to-own trailers. With financial flexibility, credit leniency, and tailored payment plans, these programs can be an attractive option for those with limited financial resources or poor credit.

However, it’s essential to consider the limitations and considerations of rent-to-own programs, such as geographic restrictions and maintenance and warranty coverage. By comparing rent-to-own with traditional financing and carefully considering your needs and financial circumstances, you can make an informed decision and find the best option for your hauling needs. Your dream trailer is within reach; it’s time to hit the road!